How Can British Expats in Spain Protect Their UK Pensions?

- Home

- Pensions In Spain

- How Can British Expats in Spain Protect Their UK Pensions?

How Can British Expats in Spain Protect Their UK Pensions?

If you’re a British expat living in Spain, understanding how to protect your UK pension should be high on your financial priority list. Ensuring that your future is secure, even if you’ve chosen to spend your golden years under the Spanish sun, is essential.

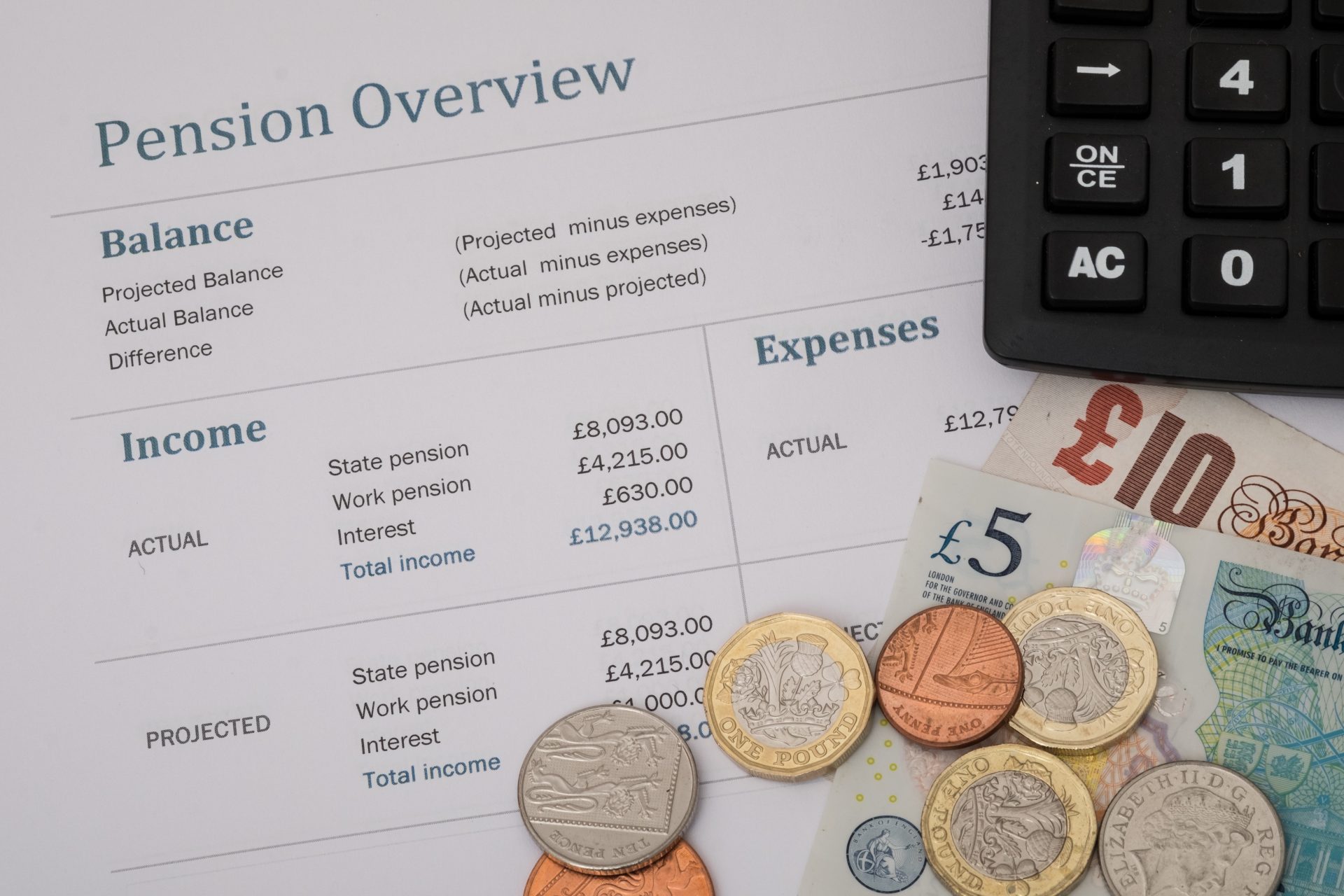

To begin, expatriates should familiarise themselves with the UK pension system’s intricacies. Knowing the difference between defined contribution pensions, defined benefit pensions, and state pensions can make a big difference. Familiarity with terms such as annuity rates, pension drawdown, and pension scheme could make the process easier.

Remember, as a British expat in Spain, you are entitled to receive your UK state pension. You can even request to have it sent to your Spanish bank account, or you can opt for an international bank transfer. Always keep an eye on the exchange rates, as fluctuations can affect your pension’s value in euros.

The good news is that you may be eligible for annual increases in your UK state pension, even while living in Spain. The UK government applies a “triple lock” guarantee to state pensions, ensuring they increase each year by either 2.5%, the rate of inflation, or average wage growth, whichever is highest.

However, protecting your UK pension isn’t just about understanding your entitlements. It’s also about making the right financial decisions to minimize potential tax liabilities. For instance, you may wish to consider transferring your pension to a Qualified Recognised Overseas Pension Scheme (QROPS) or a Self-Invested Personal Pension (SIPP). These options may provide benefits such as greater investment flexibility and potentially more favourable tax treatment.

Don’t forget that Spanish tax laws can be complex, especially when it comes to foreign pensions. As a UK pension holder in Spain, it’s essential to understand your tax obligations. You might need to consider double taxation agreements between the UK and Spain, local wealth taxes, or even Spanish succession tax.

Lastly, it’s crucial to stay updated on the changes in pension laws, both in the UK and Spain, particularly post-Brexit. Legal changes can significantly affect your pension benefits.

Navigating the world of pensions can be complex. It’s always advisable to seek expert advice tailored to your circumstances. Chorus Financial, with their deep knowledge of UK pensions and Spanish tax laws, can guide you through the process and help you make the best decisions for your financial future.

Qualified & Regulated Advice

Contact Chorus Financial today for a free, no obligation call with a qualified Financial Adviser in Spain. Provide brief information on what you need help or advice with, and let us know what part of Spain, or elsewhere, you are based in so we can assign the best Spanish based financial adviser for you.